The world would not need to invest in new oil and gas projects if demand for the fuels fell in line with the 1.5C limit on global warming, says the International Energy Agency (IEA).

The agency has been under attack from the Trump administration in the US for saying that fossil-fuel use is on track to peak this decade, given current policies and firm political pledges.

But, in a new report, the agency reiterates its 2021 finding that no investment in new oil and gas would be needed in a 1.5C world, albeit with some caveats.

The report also sets out how the oil-and-gas industry has been needing to “run fast to stand still”, spending around $500bn per year just to keep output at today’s levels.

It says this is due to output falling faster than previously thought at the world’s oil and gas fields, with an increasing reliance on shale oil and gas projects that face rapid rates of decline.

Amid growing calls for further licensing in the North Sea, the IEA also notes that new exploration licenses take an average of nearly 20 years to deliver additional oil and gas production.

Turning unconventional

The IEA report begins by arguing that discussions on the future of oil and gas “tend to focus on the outlook for demand, with much less consideration given to how the supply picture could develop”.

This is why the IEA has published a report on the rate of decline at existing oil and gas fields, as well as looking at where these fuels come from today and how this might change in the future.

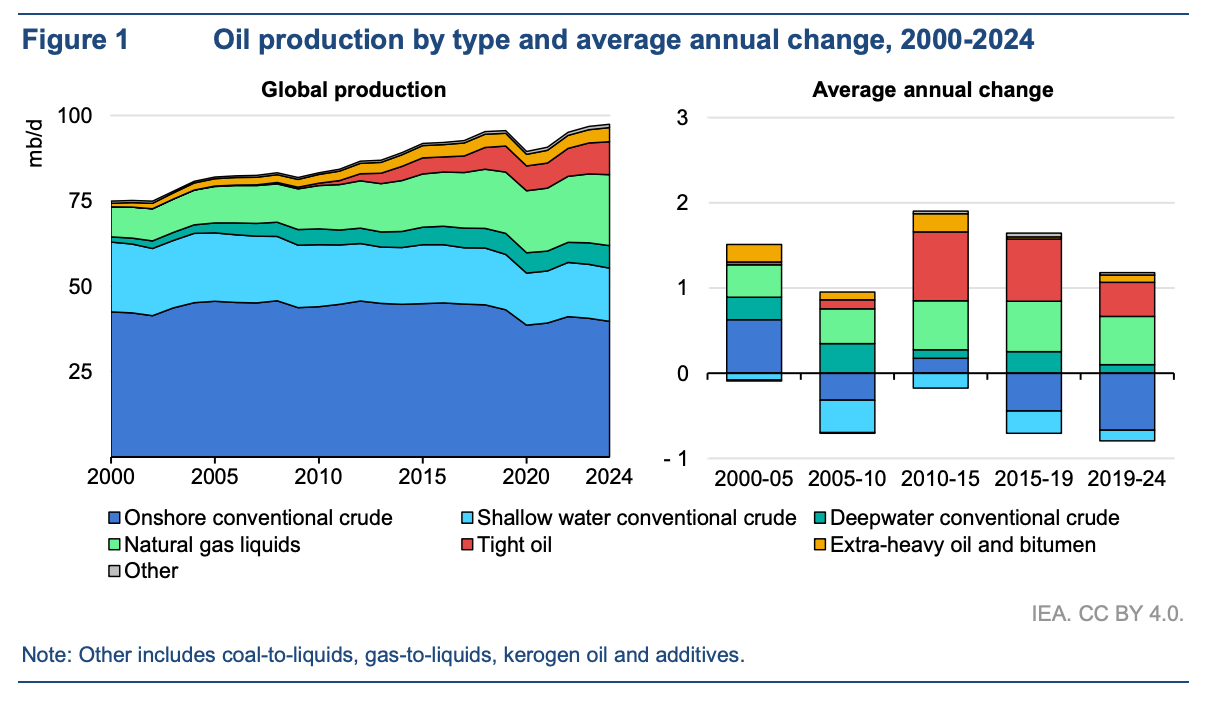

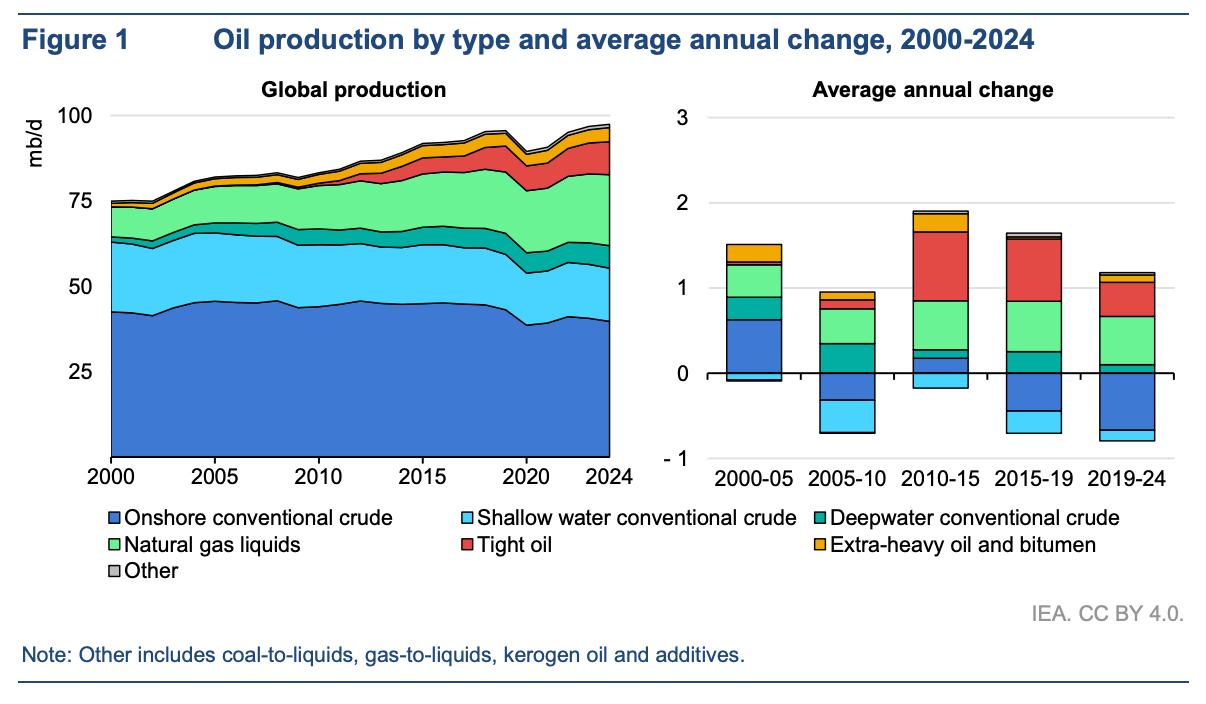

Over the past quarter-century, global oil supplies have risen by a third, as shown in the figure below. At the same time, the source of those supplies has shifted towards “unconventional” resources, such as “tight oil” from shale formations (red) and oil sands (orange).

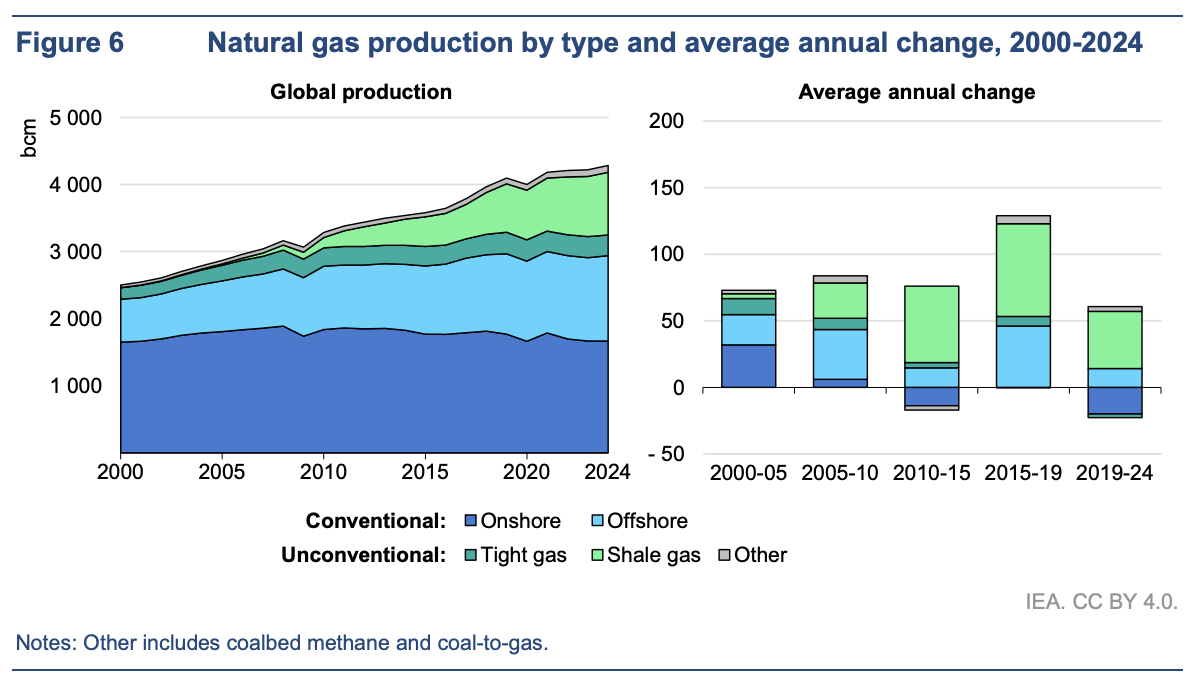

Shale gas is also behind much of the growth in global gas production over the past 25 years, shown by the green wedge in the figure below.

Accelerating decline

The shift towards unconventional resources, such as shale oil and gas, means that the output from existing fields will decline ever-more steeply without continued investments.

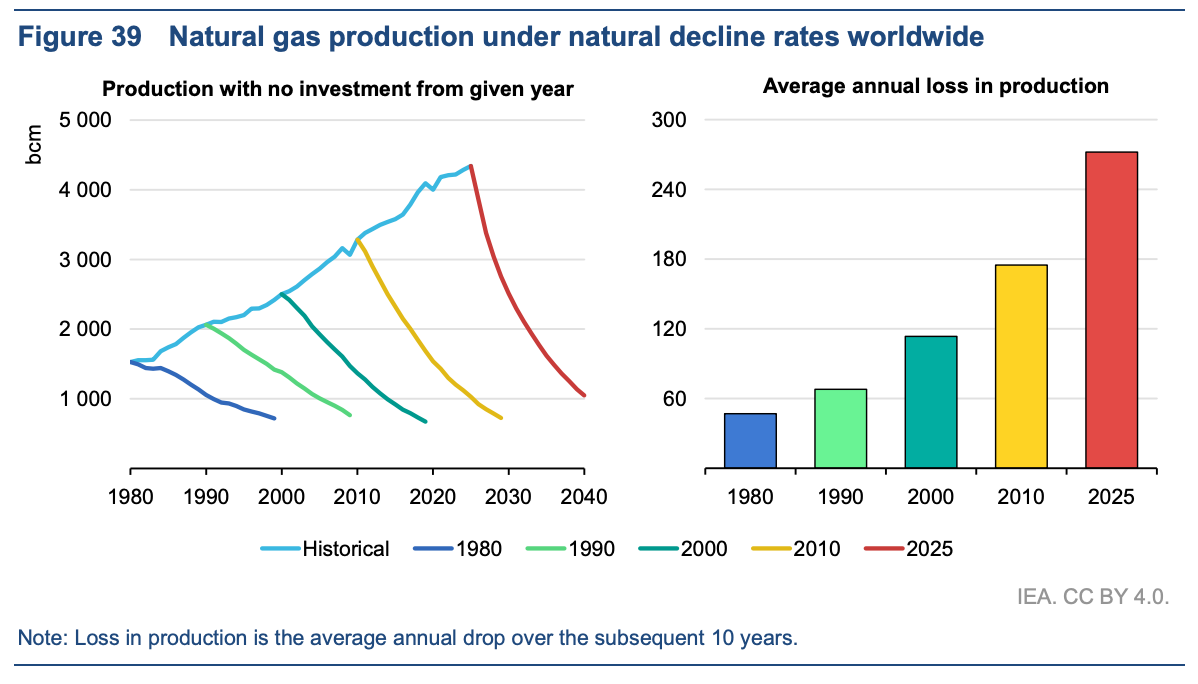

Indeed, the IEA report shows that this is already the case, with global “decline rates” for both oil and gas getting steeper – and the trend set to accelerate – as shown in the figure below, for gas only.

The consequence of these accelerating rates of decline is that the oil-and-gas industry is already needing to “run fast to stand still”, the IEA report explains.

It notes that nearly 90% of annual upstream investment in the sector since 2019 has been “dedicated to offsetting production declines rather than to meet demand growth”.

The industry needs to invest around $500bn per year, just to maintain current output, it says.

With investment set to reach $570bn in 2025, the IEA notes that this is enough to sustain “modest” production growth, but only a “small drop” away from flat or declining output.

The IEA also notes that around the world, on average, there is a delay of nearly 20 years from the issuing of oil and gas exploration licenses, until additional production starts to flow. It explains:

“This includes five years on average to discover the field, eight years to appraise and approve it for development, and six years to construct the necessary infrastructure and begin production.”

(In a recent speech pledging to “maximise extraction” of oil and gas from the North Sea, if elected, the UK’s opposition Conservative leader Kemi Badenoch talked of the need for new licenses.)

Need for new investment?

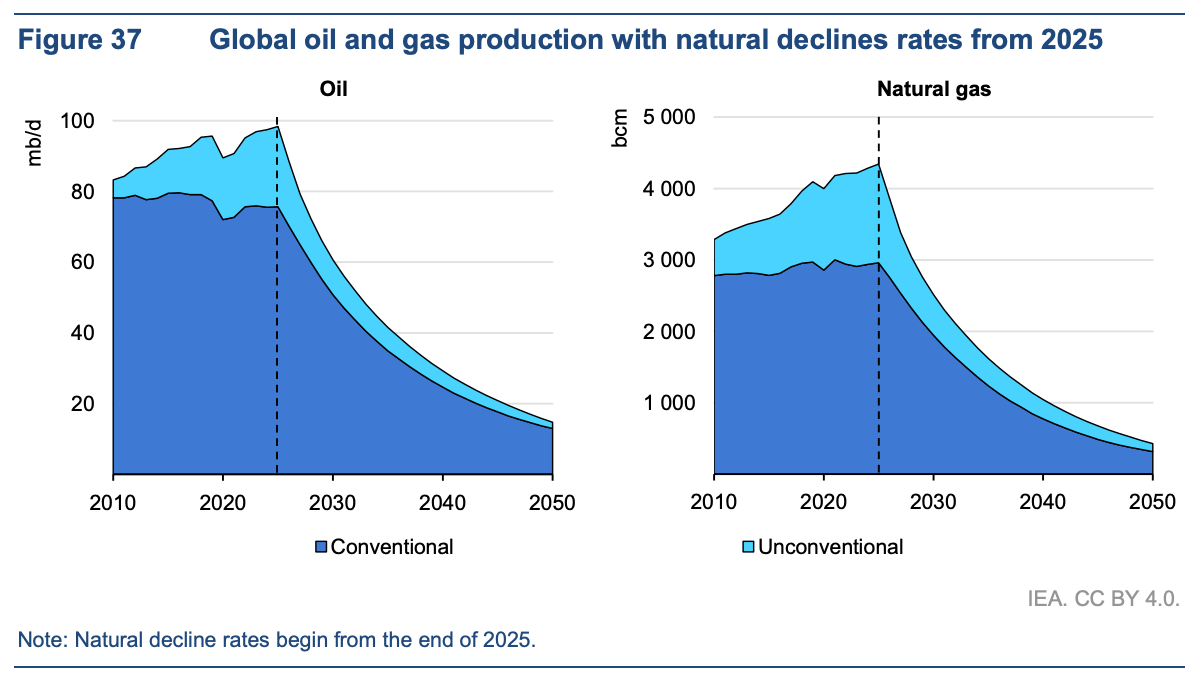

The IEA report goes on to show that without continued investment in maintaining output, global oil and gas production would plummet, as shown in the figure below.

The Financial Times said the IEA report illustrated the “costly battle” facing the oil-and-gas sector if it wants to maintain current output.

However, the newspaper added that the sector would likely welcome the findings:

“The IEA’s findings are likely to be greeted enthusiastically by the oil industry, which has consistently maintained that it needs to spend heavily to maintain its current production levels.”

The catch is that the report also spells out the implications of falling demand, in a world that limits warming to below 1.5C above pre-industrial levels.

In the 1.5C-compliant “NZE scenario”, the IEA says that a “huge acceleration in the pace of energy transitions relative to current trends” would see oil and gas demand falling dramatically.

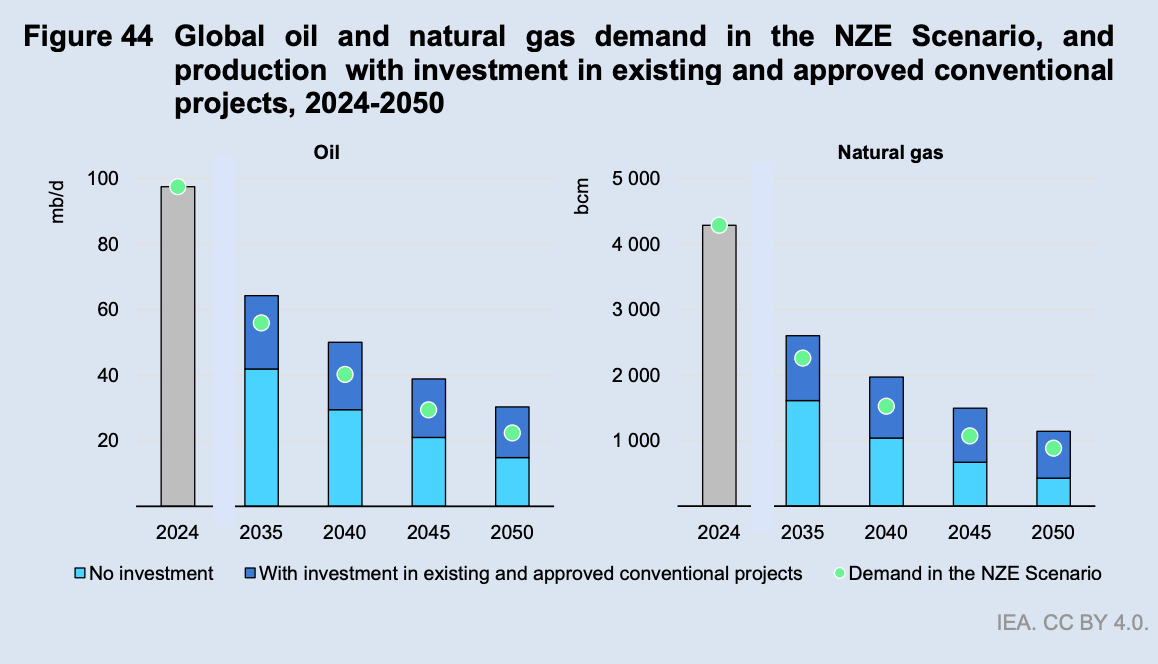

It adds that if this drop in demand were to happen, then no investment in new oil and gas production would be needed, as shown in the figure below. Specifically, the IEA report says:

“The pace of demand reduction in the NZE [1.5C] scenario is therefore sufficiently rapid that, in aggregate, no new long lead-time conventional upstream projects would need to be approved for development.”

(The IEA says that even in this 1.5C-compliant “NZE scenario”, there would still need to be some investment in “existing and approved” projects, to balance decline rates.)

The new report, thus, reiterates the IEA’s previous finding that no investment in new oil and gas would be needed if the world got onto a 1.5C path.

However, it puts the emphasis more firmly on the need for demand to decline, in order to eliminate the need for new investment, contrasting with the way this finding has been widely reported.

In its coverage of the 2021 finding, for example, the Guardian reported that oil and gas development “must stop…if the world is to stay within safe limits”.

On the contrary, the new IEA report says that investment in new oil-and-gas development will be needed to meet demand, unless demand is dramatically reduced in line with the 1.5C limit.

In addition to making this point more firmly, the IEA report notes that a swathe of the highest-cost oil and gas projects in the world would need to close early – effectively becoming stranded assets – if demand for the fuels declines in line with the 1.5C limit. It says:

“[T]o ensure a smooth balance between supply and demand, declines in demand in the NZE scenario would lead to the early closure of several higher cost projects before they reach the end of their technical lifetimes. In 2050, for example, around 8mb/d of oil production and 250bcm of gas production would be retired earlier than would be implied by observed decline rates.”

The post IEA reiterates ‘no new oil and gas needed’ if global warming is limited to 1.5C appeared first on Carbon Brief.